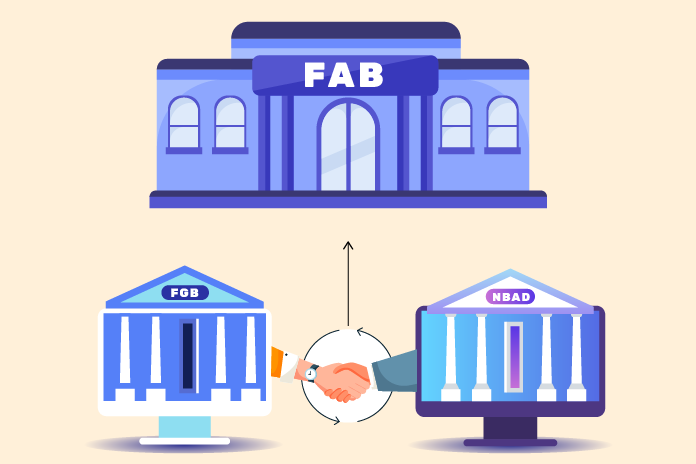

Opening an account in FAB(which was previously known as NBAD), is quite simple if the right details and valid documents are provided. Before applying for a particular account, the first step is to check the type of accounts available and the benefits provided on it.

How to open an account in FAB?

In FAB, one can open an account by visiting the branch, online or on phone.

Visit the branch: The applicant can visit the branch and submit the required documents along with the application form provided by the bank.

Apply Online: People who want to apply online can fill the application form provided on FAB website. Online applicants need to scan the required documents and submit them online.

Apply on Phone: The applicants can request an account opening by dialling to 600525500. The respective executives will visit the applicant at their desired location to get the procedure done.

In FAB, the account opening process is hassle free if the documents submitted are valid.

Once the applicant meets the eligibility criteria and all the documents are verified, it would take 3-7 working days to process an application.

Account types

Before applying for an account it is important to choose between a savings account and current account. FAB provides different kinds of saving and current accounts in UAE.

Savings Accounts

- Elite Savings Account

- Personal Savings Account

Other FAB Accounts

- Etihad Guest Elite Account

- Etihad Guest Account

- FAB Accelerator

- Elite Current Account

- FAB One Account

- Personal Current Account

- Personal Call Account

Check: How to choose a right bank account

Benefits on the FAB accounts

Each account provides exclusive benefits for the account holders. Look for the account that can be beneficial for you.

Benefits provided on FAB accounts are

- A free debit card is provided

- Can get free access to selected airport lounges

- Free monthly international remittances

- Earn Etihad guest miles on the monthly average balance in Etihad accounts

- Free teller transactions are provided on a monthly basis

- Can get a free cheque book

- Can earn profits on the balance maintained

Eligibility criteria

Once you are satisfied with the benefits provided on the account, check the eligibility criteria. Eligibility criteria to open an account in FAB is

- For some accounts, the account holder must maintain a Total Relationship balance of AED 500,000

- Even Non-Residents are eligible

- Initial deposit is required

- Even non-salaried individuals are eligible for savings accounts

Documents required

- Proof of income(for a salaried and self-employed individual)

- Valid Passport

- Emirates ID(for UAE residents)

- Valid Residence Visa(for UAE Residents)

- Visit visa(for non-residents)

Apart from these, banks may request additional documents depending on the applicant’s profile.

Things to be noted:

There are few things to be verified at the bank before submitting an application form

- Minimum Initial deposit: Few accounts have an initial deposit requirement.

- Minimum Balance: A minimum balance should be maintained in some accounts, else the account holder will be charged non-maintenance fees.

- Interest rates: Not all the accounts provide profits. It is important to check the interest rate provided on the account balance.

Having a personal bank account is important to everyone. People tend to spend less money if it is in the account rather than their pockets. Pick an account according to your requirements and maintain it rightly.

About the author

Nikitha is a Senior Analyst at MyMoneySouq.com. She has been writing about personal finance, credit cards, mortgage, and other personal finance products in the UAE. Her work on Mortgage loans has been featured by the GulfNews and other popular Financial Blogs in the UAE.