What is IBAN number?

IBAN stands for International Banking Account Number. It is an international standard, which helps recognize various bank accounts across national borders and would help minimize the risk of proliferating transaction errors. IBAN was originally developed for the European Union but now is applied globally. IBAN was first adopted as a general banking standard but was later adopted as an international standard under ISO 1 3 6 1 6 -1:200 7.

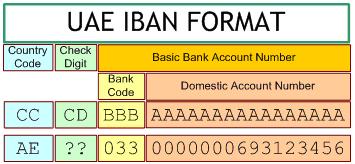

IBAN generally consists of an ISO 3 1 6 6 -, an alpha 2 country code, which is later followed by two check digits, which can go up to thirty alphanumeric characters for a basic bank account number also known as BBAN. BBAN can be fixed up to any length by any country, but its length should be fixed for the given country. IBAN is a 23 digit number, which helps in secure and easier bank transactions.

Implementation of IBAN in UAE

The UAE Central Bank has made it compulsory for the citizens of UAE to avail IBAN from their respective banks in the UAE. IBAN has been made mandatory in the wake of the fund system transfer, which went into effect in the year 2011. IBAN also helps in secure inward and outward Dirham transactions. The fund transfer system will enable the processing of transactions in a much faster and secure way as compared to the previous system.

The banks have instructed their customers to ensure that the IBAN of the beneficiary starting with AE should be mentioned in the application form.

According to the Central Bank of UAE, IBAN will help minimize the risk of any errors in transcription and will allow seamless exchange of transactions within the banks of UAE, and other banks outside of UAE which accept IBAN.

Following is the UAE IBAN account format

Where can IBAN be availed?

All the Banks in UAE, are responsible to generate IBAN for their respective account holders.

Which accounts require IBAN in UAE?

IBAN is a must for all the accounts in UAE. IBAN is set by the bank and is informed to the customers while they open an account with their bank. The banks in the UAE do not accept any transactions unless the account holders have an IBAN in their name. The implementation of IBAN helps reduce the potential identity risk in bank transfers.

How will IBAN help in smooth transactions?

Before the implementation of IBAN, individuals and SMEs used to face confusion by the differing national standards for bank account identification like the branch of the bank, account number and routing codes and it led to missing routing information from payments. Detecting transaction errors were becoming impossible for the bank and routing errors were becoming too frequent, causing payments to be delayed and incurring extra costs by the receiving and sending banks.

After the introduction of IBAN, there has been a flexible yet regular format for the identification of bank accounts and helps in validating information to avoid transaction errors. IBAN has an account identity, that can be recognized and validated in any country. IBAN contains all key bank account information.

IBAN Generation

IBAN generation has become very simple. Popular banks in UAE like Arab Bank, Standard Chartered Bank, ADCB and HSBC are asking their account holders to visit their bank websites to generate IBAN. Account holders don’t have to visit the branch of their bank. Following are the steps that an account holder should follow to generate IBAN:

- Visit the bank website.

- Follow the link of IBAN on the website.

- Enter your account details.

- Your IBAN will be generated.

The most important part about generating IBAN is ensuring to avail proper security. In today’s time, we see a number of online software that has been created to provide online generation services, but instead, they hamper the security and you might face situations, where your information might go into wrong hands.

To avoid all the ruckus, Banks have added their own link of IBAN, where the customer can enter their account details without any apprehension and generate IBAN from their respective banks.

Following is the list of top banks, whose links you can access to generate IBAN if you have an account with them.

| Name of the Bank | IBAN Link |

| ADCB | https://www.adcb.com/personalbanking/accounts/iban.asp |

| HSBC | http://www.hsbc.ae/1/2/iban |

| Emirates NBD | http://www.emiratesnbd.com/en/iban/?REF=&SRC=&SOURCE= |

| RAKBank | https://rakbank.ae/wps/portal/retail-banking/accounts/info/iban |

| Arab Bank | http://www.arabbank.ae/en/ibangenerator.aspx |

| Standard Chartered Bank | https://www.sc.com/ae/iban/tools/generator/ |

| First Abu Dhabi Bank | https://www.bankfab.ae/en/business-banking/contact-us |

| Emirates Islamic Bank | http://www.emiratesislamicbank.ae/en/IBAN/index.cfm |

| CBI | https://www.cbiuae.com/en/personal/contact-and-support/iban-and-swift-code |

| ADIB | http://www.adib.ae/what-my-iban |

| Dubai Islamic Bank | https://www.dib.ae/global/calculator/iban-generator |

At banks like Mashreq bank, CBD, Al Hilal, SAMBA and UNB, have to log in with their credentials to generate IBAN. Hence, their link has not been made public.

About the author

Manasa Netrakanti is an avid traveler and writer. Throughout her life, she has travelled to various states across the country and has also been acquainted with various languages and culture. She loves to read various books on Mythology fiction and autobiographies. Manasa wishes to become an author someday, who can inspire the world with her writing.