An account holder issuing instructions to the bank to perform or hold certain transactions on behalf of the account holder is an authorisation letter. An authorisation letter is given to the bank by the customer with a list of instructions and a signature on it. A third party can be appointed by the customer and give power of attorney to perform certain transactions of banking. This letter of authorization should be sent to the authorized banker.

It is a legal document, a transfer of power given to a trusted person to do certain transactions on behalf of you and complete banking transactions for you. Certain personal information will be included in the letter and also certain information such as names, address of the proxy holder, identity cards of the persons related to the power of attorney should be attached. You can address these details through the email. The email that you send should be addressed to the bank branch and it should be sent through registered email.

Who is responsible to perform?

A letter of authorization is proof that a certain person is authorized to perform certain actions on behalf of the owner of a bank account. There are some situations where account holders cannot perform banking functions.

When a person is sick or travelling and is not able to collect important documents then an authorized person can collect the documents. The bank account holder gives the power of attorney to the person to perform these actions. The account holder also gives responsibility to the proxy holder.

What is included in the authorisation letter?

The bank authorisation letter will include the date, details of the proxy such as address, name, nationality, identification number, id proofs, duration of authorisation, reason for non-availability of account holder and roles and responsibilities of the proxy holder.

Bank authorisation letter has a validity period of letter and reason for appointing a proxy.

Click here for Commercial banking in the UAE

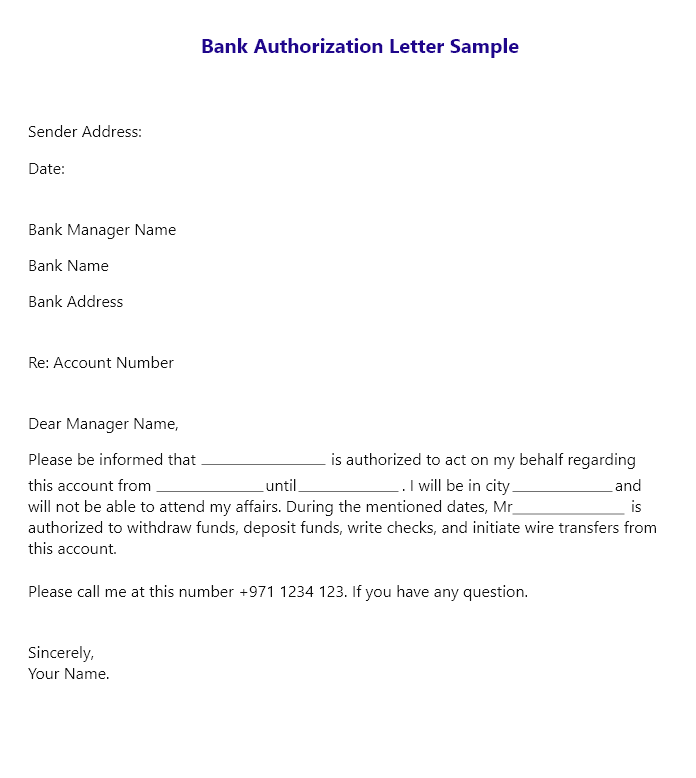

How to Write a Bank Authorization Letter?

A bank authorisation letter is a formal document and the letter should include all the formal language it should be free of informal terminology.

It is recommended that you use a polite professional language when you are writing the letter. You should include your official name on the left side of the page, your address, content date and signature. Important details such as the name of the recipient (branch manager), bank branch, the validity of letter, reason and other details. If you do not know you can include generic terms such as “To whomsoever, it may concern”.

Sample Bank Authorisation letter

Parties involved in Bank authorisation letter

There are 3 parties involved in the bank authorisation letter. The first party assigns authority, the second party being the bank and the last party is the person being delegated the authority to perform certain functions.

The parties involved in a bank authorisation letter is a group of individuals or single person.

Click here for Bank guarantee in the UAE

Purpose of Bank Authorization Letter

Bank authorisation letter can be used for the following purposes.

- When you want to close your account, you can authorise someone else to perform this action.

- If your account is frozen you can activate it

- To change a nominee and add another person as your nominee.

- Issuing a bank statement to someone whom you have authorised to collect.

Points to remember

- The letter tone should be formal, straightforward and clear. Do not compromise on the formal letter style.

- Specify the date, duration properly on the letter, it will ensure that you avoid misunderstandings

- Write the letter of authorisation in short, simple and as clear as possible.

- Use simple language to avoid confusion, misunderstanding and misinterpretation.

- Write the letter accurately and read the letter several times to reduce the errors and make it simple so that the receiver can understand what you are conveying exactly.

Take away

Bank authorisation letter is a legal document which is written by an individual or a group of individuals to give authority to someone to perform certain banking actions. It gives legal permission to do bank transactions which are not permitted to do commonly by other individuals. When you are busy at some other work you can appoint someone to do your work. Ensure that you appoint a trusted person as your proxy for the safekeeping of banking information.

About the author

Vinay Kumar Goguru is a finance professional with more than 8 years of diverse experience as a researcher, instructor and Industry work experience with both public and private entities. Prior to MyMoneySouq, he spent 6 years in Berkadia, It's a commercial mortgage banking company. He has a "Doctoral Degree in Commerce" and two master's degrees with a specialization in Finance, one as Master of Commerce and other as Master of Business Administration. He has written several articles on personal finance, published by different International journals. He loves traveling, reading and writing is his passion. He has a dream of writing a book on his favorite finance topics.