A cash flow statement is a financial statement that gives you information about the cash that you have on hand during the specified financial accounting period. Income statements give you information about how much money you spent and earned, they do not give you information about what cash in hand you have during a period of time. Income and expenses are recorded when they are earned and not when they are incurred under the accrual method of accounting.

A cash flow statement shows how well you manage your cash. The cash that a company generates to pay its debt obligations and provide a fund into its operating expenses. It is a powerful tool to analyze the financial stability of the business. It complements the income statements by reconciling the net income to net cash in hand.

In this article, we show you the structure of the cash flow statement and how you can use it in analyzing a company.

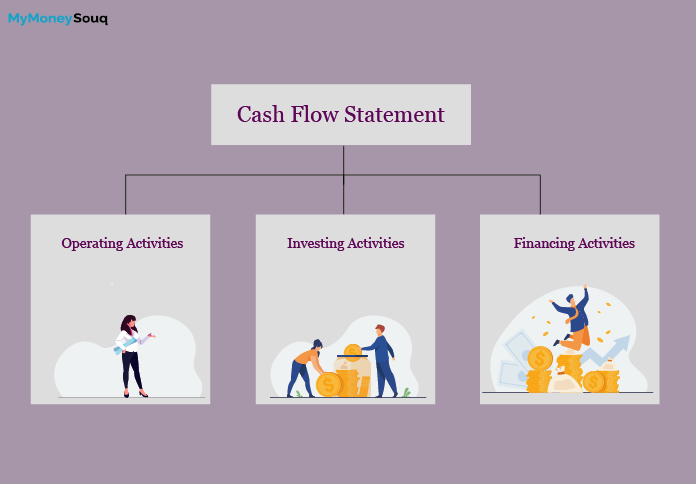

Structure of the Cash flow statement Formats

The cash flow statement format is as follows.

- Cash from Operating activities

- Cash from Investing activities

- Cash from Financing activities

1. Cash from Operating Activities- The cash flow statement operating activities include sources of cash and application of cash. It gives details of how much of cash is generated from the day to day operations of the business through its products and services. The operating activities include daily cash flow from the business operations. These expenses include the following.

- Receipts from sales of goods and services

- Interest payment

- Income tax payables

- Supplier payments for distribution of goods and services

- Salary payments or wages payments

- Rent payables

- Other operating expenses.

The cash flow transactions can be different from one business to another and they can also be different from one company to another company. In a trading company, the receipts of the sale of loans, debts, and equity are also included. The purchase and sale of long term assets are not included.

2. Cash from Investing activities- Investment activities are the investments made by the company. These are the purchases made by the company and invested in investments in equipment, real estate, land or financial products. These investments are cash equivalents. The cash that is spent on investments is converted into assets. The cash in hand will be removed and made into investments. The investments have cash value but they are not equal to cash.

Example – The purchase of equipment in business concerns is recorded at AED 5,000 for assets on the income statement. It is an asset and it is not cash. AED 5,000 on cash flow statement means that AED 5,000 will be deducted from cash on hand.

Click here for Real estate investments in UAE

3. Cash from Financing activities- These activities include income earned or cash liquid assets spent on financing activities. Under financing activities, money from bank accounts gets reduced when payments are made towards dividends, payments made for debts, stock repurchases and other financing activities. When there is the capital raised in business there is cash into the business and when there are dividends paid there is cash out from the business. The company receives cash if it issues the bond and when interest is paid to bondholders the cash from the company goes out of business. There is a reduction in the cash flow.

Examples: Borrowing money from banks and repaying loans. Borrowing cash and repaying long term liabilities. Paying cash dividends on capital stock. Issuing or repurchase of shares.

Click here for 5 Ways to Protect your finances in tough times

How to analyze a company using a cash flow statement?

The cash flow statement helps you to understand where the cash is coming from and where it is going for. How money is spent and how investors determine the company’s financial position. The creditors can find out how the company is performing and how much cash is available in the business to pay for operating expenses and financial debts. It helps in knowing the inflow of cash and outflow of cash. The inflow of cash and outflow of cash.

- The inflow of cash- Any business transaction that leads to an increase in cash is called the inflow of cash. Example: sale of fixed assets, sale of investments, and others.

- The outflow of cash- Any business transaction that leads to a decrease in cash is called an outflow of cash. Example: Payment of rent, purchase of equipment, and other expenses.

The information from the income statement and balance sheet is used to create the cash flow statement. The income statement will give you information about cash that is entered into the business and left from your business. The balance sheet gives you information about accounts receivable, payable, and inventory. This can be understood with the following statement.

Balance Sheet + Income Statement = Cash Flow Statement

The statement of cash flows will help in evaluating the business. Future cash flow projections are made possible by the statement of cash flow. The following aspects can be analyzed by looking at the cash flow statement.

- You can determine the financial position of the business

- Cash projections and requirements of cash for the business can be determined.

- The volume of cash deficiency can be determined by the cash flow statement.

- Helps in forecasting the ability of the firm

- For short term analysis, it is much easier to understand than the funds flow statement.

Take away

The future outlook of the company, profitability, and strength of the company can be determined by the statement of cash flows. This statement is enough to find out how cash is enough to pay for its expenses. Predictions can be made in business using cashflow statements and budgets can be prepared to deal with the uncertain future. The company’s financial health is reflected in the cash flow statement. The more cash available for operating the business the better is for the business. Business expansion plans can be made with the help of cash flow statements. The investors can get a clear understanding of the business by studying the cash flow statement. Thus, the statement of cash flows gives you knowledge of the financial well being of the company.